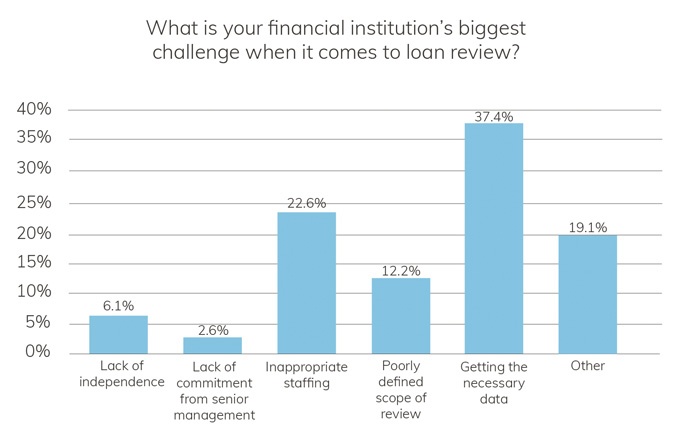

Staffing concerns and getting the necessary data are financial institutions’ biggest challenges when it comes to performing loan reviews, according to a new survey by Abrigo.

Among 115 people from banks, credit unions, and other organizations surveyed about the loan review function, 37% named getting the necessary data as the top challenge. Almost one in every four respondents identified inappropriate staffing as their financial institution’s biggest loan review obstacle.

A poorly defined scope of review (12%), lack of independence (6%), and lack of commitment from senior management (3%) were less prominent challenges in the loan review process for respondents in Abrigo’s survey.

Effective loan review begins with good data

Effective loan review has always been critical for managing a financial institution’s credit risk as part of ensuring its safety and soundness. Uncertainty related to the coronavirus pandemic highlighted the importance of identifying loans with actual or potential credit weaknesses as early as possible.

In addition, updated guidance on loan and credit risk review in 2020 emphasized the importance of independent loan review or credit review systems that are tailored to institutions’ specific risks and circumstances.

However, loan reviews can only be as accurate as the information used for the review. And as the survey showed, getting the necessary data can be difficult for many financial institutions. Loan reviewers require accurate information at the loan level, which, at many institutions, might be located in multiple systems:

- the core

- a third-party origination system

- Excel spreadsheets

- even paper files for some documents related to collateral.

More lenders automating loan review function

Getting consistent and accurate data can be complicated and laborious when stovepipe systems and manual processes are involved, especially when inappropriate staffing is also a concern. Some loan review workflow automation software, on the other hand, can pull a sample of loans and the required data, then automatically respread the loans’ financials without additional data entry or searching other systems.

Automating the loan review process and other data-intensive functions have become higher priorities for many financial institutions and organizations over the past few years. A recent example is the U.S. Small Business Administration, which is automating low-end functions of loan reviews for 7(a) loans to cut loan reviewers’ evaluation time by as much as a third so they can focus on high-value work.

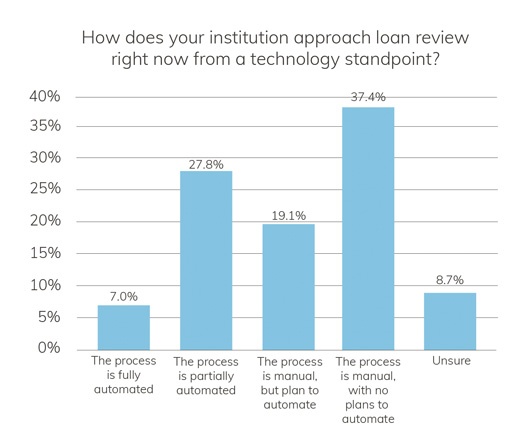

Abrigo’s survey found that more than half of respondents either have automated or plan to automate loan review processes. Respondents with fully or partially automated loan review processes represented 35% of those surveyed, and another 19% reported they have plans to automate loan review processes. Thirty-seven percent said their financial institutions have manual loan review processes and have no plans to automate.

How lenders select loans or relationships for review

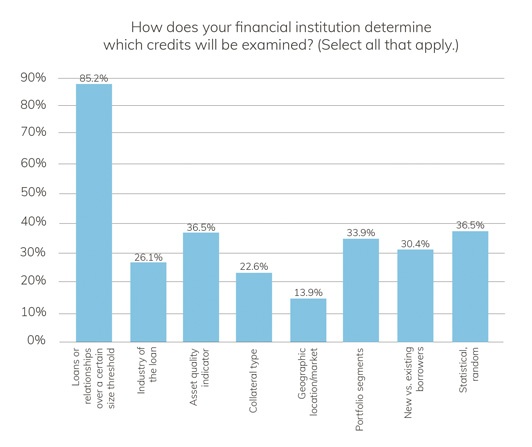

Financial institutions vary in their methods for selecting samples of loans or credits to review, and sometimes the sampling criteria can differ by portfolio. Therefore, participants in Abrigo’s survey were able to choose multiple answers when asked how they determine which loans or relationships to review. Most respondents (85%) said they base the review sample on a certain size threshold. The next most common methods were choosing a statistical or random sample (37% of respondents) and basing the sample set on an asset-quality indicator (37% of respondents). Respondents said they also selected loans or relationships for review:

- By examining new rather than existing borrowers (30% of respondents)

- Based on the industry of the loan (26%)

- Based on the collateral type (23%)

- Based on the geographic location or market (14%)

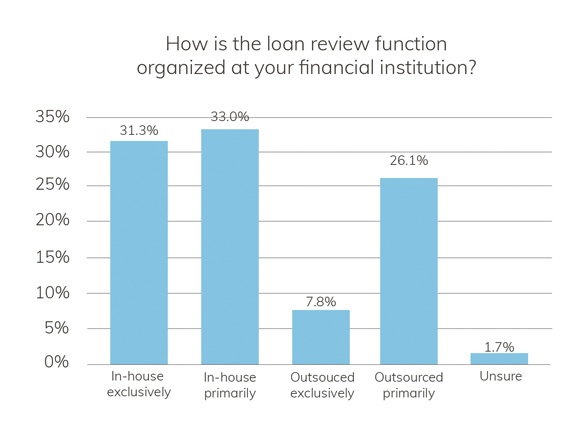

When it comes to organizing the loan review function, Abrigo’s survey found that a majority of financial institutions performed at least some of the loan review process in-house. Only 8% of respondents outsource all loan review work, and 26% primarily outsource the function, while 31% perform loan review in-house, and another 33% primarily conduct loan review using in-house resources.

Abrigo’s survey was conducted from Sept. 2-24. Among the 115 respondents, 77% were from banks, 21% from credit unions, and 3% from other organizations. The asset-size breakdown among participants was:

- Below $500 million: 28%

- $500 million to $3 billion: 51%

- $3 billion to $10 billion: 14%

- More than $10 billion: 7%

Mary Ellen Biery is Senior Strategist & Content Manager at Abrigo, where she works with advisors and other experts to develop whitepapers, original research, and other resources that help financial institutions drive growth and manage risk.