If there was a gold medal for financial services, lenders earned it in 2020 and 2021.

The rollout of the Paycheck Protection Program’s (PPP), its associated changes, the next tranche of PPP, and the next, and now forgiveness (not to mention bankers’ work with some existing business borrowers to modify loans under government programs), has kept staff at banks swamped for more than a year. These factors, most likely, have also kept most lenders deep inside their loan origination systems more intensely than at any other time in their history.

Widely reported, many financial institutions took the opportunity during the COVID-19 pandemic to digitalize some or many of their financial institution’s processes and services, including lending.

Abrigo’s 2021 Business Lending Process Survey found that a slight majority of respondents (53%) accelerated digital transformation plans as stay-at-home orders and other social distancing measures forced workers and customers alike out of branches or lending centers.

Largest lenders led the digital push

Digital transformation varied somewhat by the size of the financial institution in Abrigo’s survey. 77% of institutions topping $10 billion in assets accelerated digital transformation plans due to the pandemic. That compares with:

- 46% of respondents from institutions with $3 billion — $10 billion in assets

- 50% from institutions with $500 million — $3 billion in assets

- 52% from institutions with less than $500 million in assets

COVID-19 and related events also led many banks to refocus on efficiency. Nearly half of respondents in Abrigo’s survey said their institution renewed an emphasis on finding efficiencies due to the pandemic.

And just as the larger institutions more frequently reported accelerated digital plans than did smaller institutions, a larger share emphasized renewed efficiency among smaller banks and credit unions.

However, despite digital pushes and efficiency focuses, lenders across the board in Abrigo’s survey reported their financial institutions use manual lending processes that add costs, create delays, and make their staff work harder than they must. Some of the same methods are also known for hurting lenders’ ability to drive loan growth, manage credit risk, and satisfy customers or members.

Repetitive data entry is a top lending obstacle

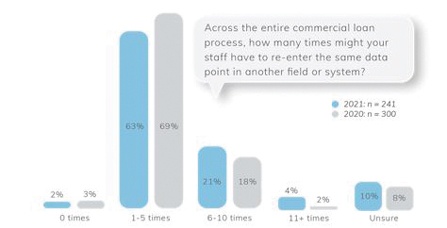

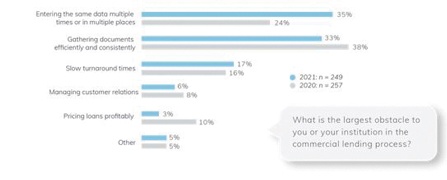

One example of processes that add costs, create delays and make staff work too hard is repetitive data entry. Most frequently named as the most significant obstacle to respondents or their institution in the commercial lending process was entering the same data multiple times or in multiple places. 35% of those surveyed identified repeated data entry as their largest lending hindrance.

What is the magnitude of repetitive data entry in business lending? Nearly two-thirds of respondents said their financial institution reenters the same data point for a loan in another field or system up to five times. A quarter of respondents reported entering the data at least six times. In a similar survey by Abrigo in 2020, 20% of respondents said they entered data at least six times.

In addition, only one of every three respondents in Abrigo’s survey this year said their institution currently offers the ability to apply online for a commercial loan. Lenders with online applications can often port the borrower data across the origination platform, resulting in fewer repeat data entries. The good news is that a higher share of survey participants said they now offer more online business loan applications than they did last year when only 20% offered them. However, this year 13% of respondents said their institution does not provide or plan to offer online loan applications in the future.

Manual credit memo = more time

Another process typically tied to repeated data entry is the credit memo — unless it is automated.

Only 7% of financial institutions in Abrigo’s survey reported using an automated solution to generate the credit memo. Instead, nearly half said their institutions enter this critical information manually. Another 42% reported using a combination of manual and automated methods.

Manual credit memos were most prevalent among the largest institutions in Abrigo’s survey this year. Two-thirds of respondents from institutions with assets over $10 billion reported entering credit memo information manually, and the other third reported using a combination of automated and manual systems.

To create a credit memo the loan committee can review, a credit analyst is often inputting data from disjointed systems repeatedly. They must manually input consolidated borrower information, financial ratios, any global cash flow analysis, the assigned risk rating, proposed loan pricing, and terms of the proposed loan. Even using institution-created templates might not eliminate the need to cut-and-paste data, review for errors, and rewrite certain sections, depending on the template and loan. This time spent on administrative tasks throughout the life of the loan ultimately reduces the time an analyst can spend analyzing a business loan. Another potential consequence could be a longer processing time for business loans.

‘Speed and consistency make or break a deal’

“Process automation is incredibly important in today’s lending environment,” said Brandon Quinones, Abrigo’s Director of Client Education. “Speed and consistency will make or break a deal, so putting a system in place to drive that automation – enabling financial institutions to spend less time on redundant data entry or requests and more time on value-add activities – is something industry leaders recognize as no longer just an option for their business.”

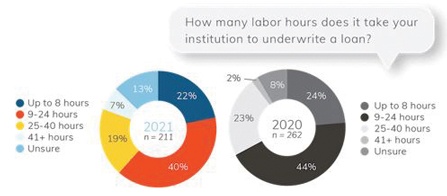

Forty percent of bankers said it takes their institution between nine and 24 hours to underwrite a loan. While 22% said their institutions could complete underwriting in less than a business day, another 19% reported a 25- to 40-hour window, and 7% said underwriting can take more than 40 hours.

Including all processes, 46% of respondents said their financial institutions take at least five weeks to close a commercial loan. That figure includes many institutions (16% of respondents) requiring eight weeks or more.

Of course, banks focused on commercial real estate loans, which often require appraisals and entail more intense scrutiny than a small line of credit, tend to have longer turnarounds. However, the long wait time for a credit decision is historically the chief complaint among borrowers using small banks for financing. And with the economic outlook improving, lenders looking to grow the business loan portfolio in the quarters ahead with credit-worthy borrowers will face tight competition for them.

Document collection also a pain point

Another ongoing obstacle to the lending process, according to survey respondents, is being able to collect required documents. A third said gathering business loan documents efficiently and consistently is the most significant obstacle in their institution’s commercial lending process. This was also the most frequently identified top lending obstacle from respondents in Abrigo’s 2020 survey.

Asked about their biggest headache related to loan ticklers, the documents required for every loan file, 65% of respondents said it is tracking and following up on missing items. Only 17% of respondents said their institution uses automation for ticklers.

In addition to gauging the current state of digitization and automation within financial institutions’ business lending processes, the Abrigo survey also assessed how banks are approaching other areas of business lending, including pricing loans, assigning credit risk, and growing their portfolio. The 2021 Business Lending Process Survey results highlight the importance of institutions finding ways to overcome inefficiencies and inconsistencies to scale loan growth and manage risk.

Some processes vary by institution size. For example, the highest share of respondents from institutions with more than $500 million in assets said they set prices on loans based on internal profit measures, such as return on assets or return on equity. But among lenders with less than $500 million in assets, the top loan pricing method was setting prices based on lender discretion and negotiation with the client.

Abrigo surveyed nearly 250 lenders, credit analysts, chief credit officers, chief risk officers, and other professionals involved in lending and credit risk at banks and credit unions in an online survey between Feb. 18 and March 23, 2021.

Mary Ellen Biery, senior writer and content specialist at Abrigo. Abrigo is a leading technology provider of compliance, credit risk, lending, and asset/liability management solutions that community financial institutions use to manage risk and drive growth. Visit abrigo.com to learn more.