By focusing on the problems we’re trying to solve and how those solutions will benefit our customers, we can separate timely initiatives from those that can wait.

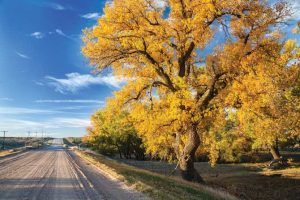

In today’s climate, the road ahead feels uncertain. Between growing inflation and fluctuating interest rates, the future

may seem more clouded than ever, leaving us to ponder, “Where’s the crystal ball when you need it?”

Yet, it doesn’t require clairvoyance to chart our path ahead; we can rely on our history and our experiences to map the

course. For hundreds of years, community banks have stood strong, adapting to market changes and evolving to serve our communities. Through industry highs and lows, community banks have risen on a foundation of relationship banking and thoughtful preparation.

Market shifts mean we must come back to those basics today, focusing on our strengths and what we can do to continue to excel. What sets us apart? How can we best demonstrate our commitment to our communities in the products and services we offer? Examining our strategic initiatives through this lens will help us ensure we aren’t simply reacting to a sense of urgency but proactively preparing for what lies ahead.

And we wouldn’t be community banks if we didn’t approach our businesses from a customer-first mentality. Fortunately, we have access to technological tools that enable data to tell our success stories. We have information on customer preferences, behaviors and needs, which, in turn, allows us to make strategic decisions about how to prioritize our efforts and get real success stories out into the mainstream.

But with everything in life, we can’t do it all. We need to prioritize as we enter budget discussions over the next few months. Our banks, customers and communities will benefit when we align objectives with the potential solutions or opportunities that will make the most impact. By focusing on the problems we’re trying to solve and how those solutions will benefit our customers, we can separate timely initiatives from those that can wait.

As you read this month’s budget issue, we hope you uncover ICBA resources to support you in your planning. From courses with Community Banker University to our ThinkTECH initiatives to Bancard’s Payments Strategy Guide and the ICBA Tell Your Story Marketing and Communications toolkit, we strive to provide solutions to help you address this post-pandemic society of instant gratification and digital transformation in a thoughtful, strategic manner.

It’s no surprise that uncertain times lie ahead, but I can confidently say that community banks will continue to thrive with ICBA by their side. I don’t need a crystal ball to tell me that, though, because as they say, the best predictor of the future is past behavior, and for community banks, our steadfast history bears repeating for the customers and communities that continue to depend on us.

Where I’ll Be This Month

Like you, I’ll be kicking off our budget processes at ICBA, and with that spirit of fresh opportunities in mind, I’ll be dropping my oldest daughter off at college, and my youngest will be starting high school.

Connect with Rebeca on Twitter @romerorainey